TLDR: See the infographics below for quick education content.

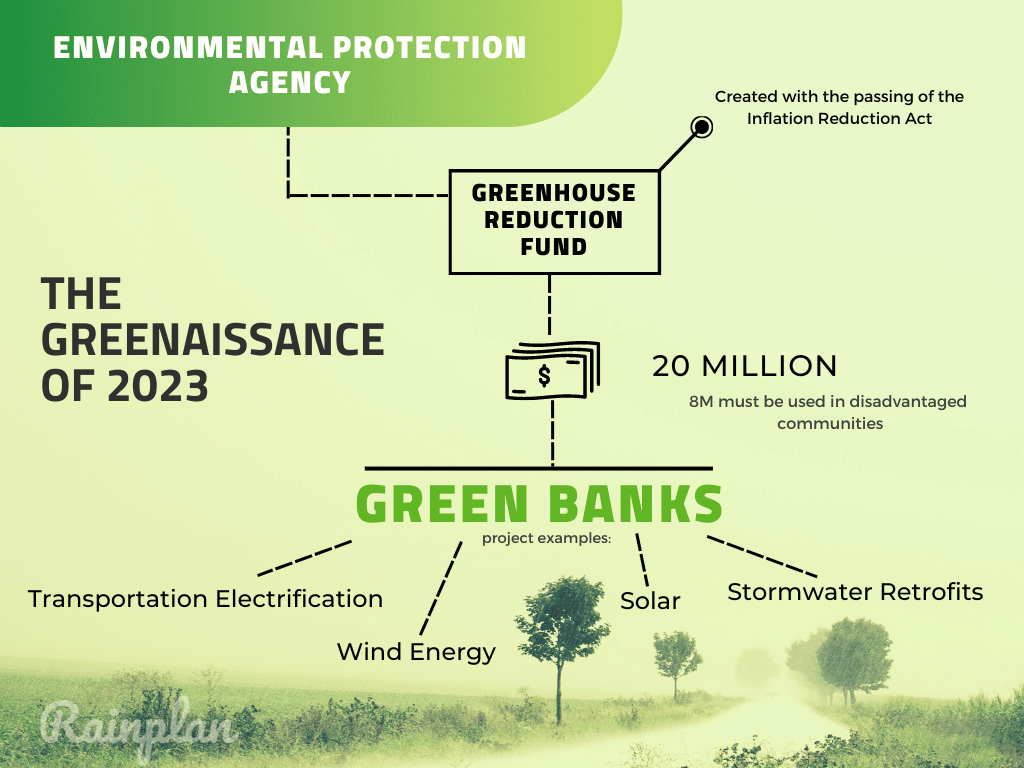

With the passing of the Inflation Reduction Act (IRA), types of green finance and how they will be utilized have become of interest to not only the public but also investors. The IRA was a large package involving healthcare, inflation reduction, and economic stimulus. Still, at its core, it was a climate change bill with sights set on funding and growing economic development around sustainability. Proof of that comes from the bill creating the United States’ first national green bank, the EPA’s Greenhouse Gas Fund, which will oversee how funding gets dispersed down to the states and, in particular, to regional green banks.

With new funds allocated to expanding incentive programs and green bank financing, the influx of capital is attracting more private investment. Consider the rising growth of VC investment in clean energy.

“Overall median deal value in the clean energy tech space has increased every year since 2017, expanding particularly fast from 2021 to 2022 by 56.3%.”

–Pitchbook 2022 Q3 Clean Energy Report

With momentum heating up across clean energy and green infrastructure business, now is the time to understand the conductor orchestrating the movement of increased “green and clean” capital: green banks have entered the chat.

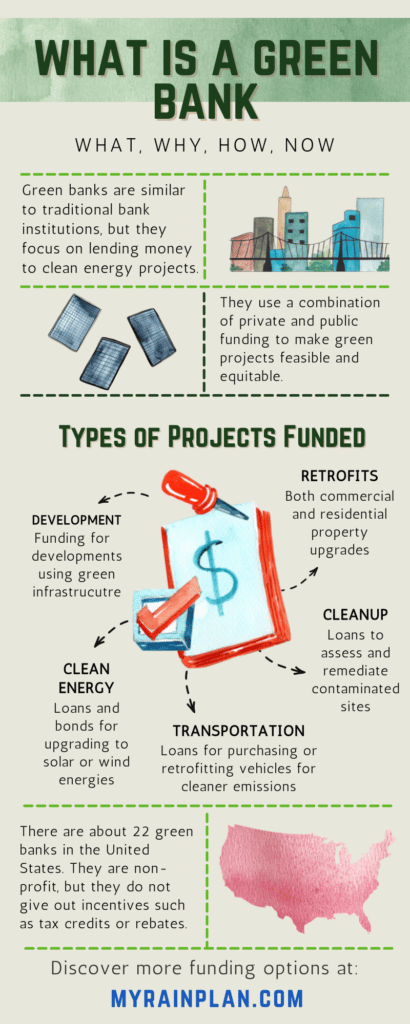

What is a Green Bank

A green bank operates like a traditional bank regarding financing projects based on potential and return. A green bank differs from conventional banking practices because the objective is to bring equity to clean energy and environmental infrastructure projects while still allowing for profitable investments. Why aren’t traditional banks already doing this? Green projects and their financing are “higher risk.” A traditional bank may need more data or understanding to make the investment sensible and satisfy its risk levels. However, green banks tend to employ expertise in clean energy infrastructure (solar, wind, stormwater, electrification, etc.) and are willing to take on the risk because they know how to mitigate challenges and analyze potential scale. Green banks also differ in that they use a combination of both public and private funding to start these projects.

How Is Everyone Getting Paid

Under the Inflation Reduction Act, $27 billion would be granted for EPA distribution through the Greenhouse Gas Reduction Fund, a large majority of that being laid out to regional green banks to finance projects. Concerning private funds, a green bank pools loans into sustainability portfolios, reducing their risk on investment because of the spread. While some clean energy projects are at higher risk and with limited scale, if a bank can aggregate projects over time, it can then afford to underwrite them and sell off loans to private investors. Another benefit of green banks for private investment is it allows private capital providers to latch into the clean energy game momentum like never before.

There are numerous financing structures that green banks can utilize to help provide gap financing, loans, and more. Here’s a high overview from the Coalition for Green Capital.

Why Green Banks Matter

Everyone needs financing or capital to get green projects off the ground. Speed, research, and continuous investor interest are vital to creating what could be considered an “optimistic” clean energy future. Besides the apparent angle of providing capital, green banks also allow projects to test new technologies and materials that otherwise wouldn’t happen. For example, with more private investment and crowdfunding, material companies like Aquipor can develop and test permeable concrete materials to help with stormwater management and water quality.

Then there is the equity (what you might see as EJ or Environmental Justice) of green bank financing. The historically disadvantaged communities are the most vulnerable to climate change effects, built in areas with poor drainage, more concrete, and less electrification potential. These areas have the most need for retrofit financing and would benefit significantly from available capital with low-interest loans. With the democratization of green tech financing, people from various socioeconomic backgrounds can afford to retrofit or upgrade to cleaner green tech. Ultimately if these projects can be implemented, everyone benefits from lowered utility costs, dependency on foreign assets, and enhanced quality of life.

With private capital and our nation’s capital finally in sync on sustainability projects, it’s an exciting, or at least hopeful, time for climate change advocacy in the United States. Long and loud were the battle cries that clean energy and green infrastructure would always be too expensive. Still, was it ever too expensive, or was it simply not attracting investors’ eyes? With federal funds being directed to green banks and incentive programs, private funds are sure to follow, and with those dollars comes the hope that we can speed up the implementation of sustainable cities.

Rainplan and the DC Green Bank Partnership

So why am I spending time on an article about Green Banks? Rainplan is pleased to announce that we closed on a $2M deal with the DC Green Bank to be a source of funding for SWPPP, small businesses, and residential projects. Essentially the DC Greenbank has provided Rainplan with a debt facility of 2 million, so we can finance projects and help empower green infrastructure adoption.

You can read more about the impact this deal will have via our joint press release.