Green Investment Banks: Types of Green Finance

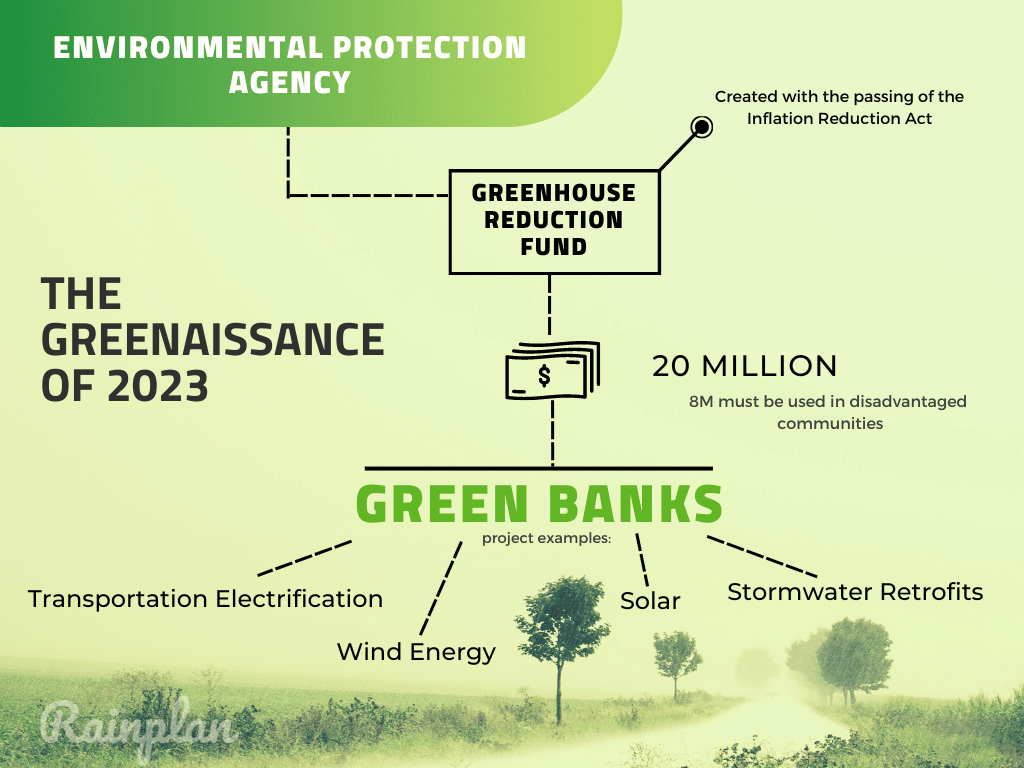

With the passing of the Inflation Reduction Act, types of green finance have become of interest to the public, as has an interest in a coalition for green capital. The Inflation Reduction Act was a large package involving healthcare, inflation reduction, and clean energy financing.

With new funds being allocated to green banks and incentive programs from the federal budget, now is an excellent time to read up on types of green finance and, more specifically—the importance of greenbanks.

What is a Green Bank

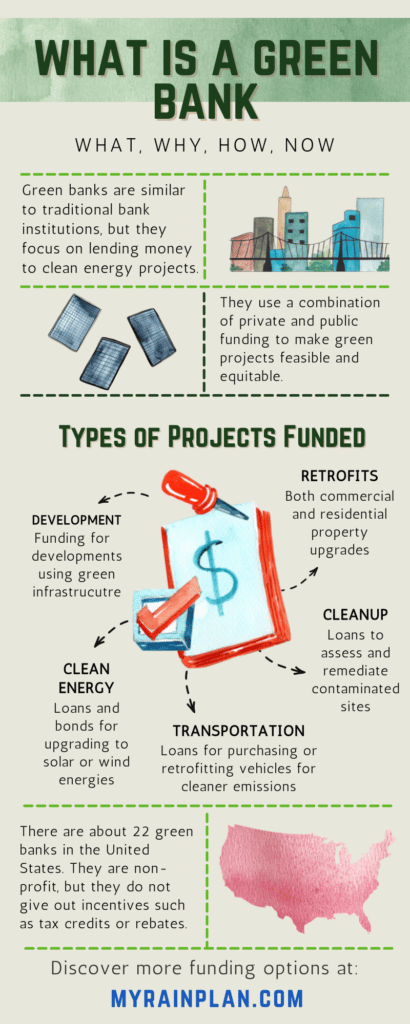

The first green bank started in Connecticut in 2011, and since its inception, approximately 22 have sprung up across the US. With many more on the horizon.

A green bank operates like a traditional bank in financing projects based on potential and return. Where a green bank differs from traditional banking practices is that the objective of financing is to bring equity to clean energy and environmental infrastructure projects. These projects are at higher risk for a traditional bank that may not have the data or understanding to make the investment lower risk. However, green banks tend to have the expertise in these areas (solar, wind, stormwater, electrification, etc.) and are willing to take on financing a higher-risk investment. Green banks also differ in that they use a combination of both public and private funding to start these projects.

Wait? Public Funds?

Some countries, Australia, for example, have a national green bank that uses public funds to help fund clean energy or green projects. In the United States, there has been a push for the first green bank on a national level that would use federal funding, while with the passing of the Inflation Reduction Act looks like we might be heading in this direction; for the moment, most green banks are regionally based and use a combination of public and private funds. Under the Inflation Act, $27 billion would be used in the Greenhouse Gas Reduction Fund–which essentially creates our first national green bank. Something that many entities, like the Coalition for Green Capital and US Greenbanks, have been championing for a while.

Why Do We Need Green Banks

We know that to create a sustainable society, we must deploy rapid clean energy and green infrastructure practices. To get these projects going, everyone needs financing or capital for projects. Green Banks’ green projects happen in new markets and locations and give new technologies a chance that otherwise wouldn’t happen. Ultimately if these projects can be implemented, everyone benefits from lowered utility costs, inflation costs, dependency on foreign capital, and cleaner environments.

Financing Potential

Another great reason for green banks is that it gives private capital providers a chance to get into the clean energy momentum. While some clean energy projects are at higher risk and with limited scale, if a bank can aggregate projects over time, it can then afford to underwrite them and sell off loans to private investors.

There is also equity in financing as a significant bonus for green banks. This means that people from various socioeconomic backgrounds can afford to retrofit or upgrade to cleaner green tech. This is only possible through the democratization of green tech financing.

There are numerous financing structures that green banks can utilize to help provide gap financing, loans, and more. Interested in learning more? Here’s a high overview from the Coalition for Green Capital.

Rainplan and the DC Green Bank Partnership

So why are we spending time on a blog about Green Banks? It’s because Rainplan is pleased to announce that we closed on a $2M deal with the DC Green Bank to be a source of funding for SWPPP, small businesses, and residential projects. Essentially the DC Greenbank has provided Rainplan with a debt facility of 2 million so we can finance projects and help bring about adoption in the stormwater sector.

You can read more about the impact this deal will have via our joint press release.